Here’s why you want a Student Additions Account

-

Save up to £1,500 in textbook costs with a free three-year subscription to Perlego’s online library of books, academic texts and tools. Terms and conditions apply3. Offer ends 13 December 2024.

-

Apply for an interest-free overdraft 4 of up to £1,500 over the course of your studies

-

No hidden charges for student banking – you don’t have to pay to open or use your account

-

Our app helps you keep tabs on your spending and bills

-

It's easy to get in touch online, by phone or at a branch.

How to apply

Have you lived in the UK for more than three years?

You can only apply for a student account if you’ve lived in the UK for more than three years. If you haven’t, you can apply for a Barclays Bank Account in the app1

Student Additions Account

To apply for this account, you’ll need to:

- Be 18 or over

- Be studying full-time in the UK as an undergraduate, postgraduate or higher apprentice

- Have lived in the UK for more than three years

- Use this account as your main account where your student loan and/or income will be paid into.

-

If you’re waiting for a confirmed offer from your college or university, you can still start your application. You can complete your application when you get your offer.

-

You can start your application in our app1. To complete your application, you’ll need to visit us in a branch and provide a letter from your university or employer to confirm your course or apprenticeship details.

How to apply in our app if you're new to Barclays

When you first download and open our app, we’ll ask you to

- Create a passcode to access the app safely

- Take a picture of your identity document

- Record a short video of yourself, which we’ll use to check your ID

- Provide some details about your course and your UCAS status code

- Consent to a credit check

That’s it – we’ll let you know when you can start using your new account. Then you can switch any regular payments from another account to your new account with us.

You can apply for an interest-free arranged overdraft

If you’re a UK student, you don’t need to pay interest on arranged overdrafts up to £1,500.

Our maximum interest-free arranged student overdraft limits are

- From account opening and during your first term: up to £500

- Year 1: up to £1,000

- Year 2 and beyond: up to £1,500

No interest is payable on arranged overdrafts.

In the first 3 months, a 0.0% annual rate of interest (variable) is payable on arranged overdrafts up to £500. 0.0% APR Representative is based on a £1,200 overdraft balance. There may be other rates for different credit and/or debit balances. For the Student Account, the maximum interest-free arranged overdraft limits are £500 in your first term, up to £1,000 in year one and up to £1,500 in year two and beyond. Credit is available subject to financial circumstances, borrowing history and lending criteria.

Arranged overdrafts are repayable on demand. Interest charges are variable.

General information about overdrafts

An overdraft limit is a borrowing facility which allows you to borrow money through your current account.

There are two types of overdraft – arranged and unarranged.

An arranged overdraft is a pre-agreed limit, which lets you spend more money than you have in your current account. It can be a safety net to cover short-term outgoings, like an unexpected bill. It is not suitable for longer-term borrowing. We charge you for every day of the month that you use your arranged overdraft where you go beyond any interest free limit you may have.

An unarranged overdraft is when you spend more money than you have in your current account and you have not agreed an arranged overdraft limit with us in advance or you have exceeded an existing arranged borrowing facility.

You can only make payments from your account if you have enough money in your account or through an arranged overdraft to cover them. Barclays will always attempt to return any transaction that could take your account into an unarranged overdraft position. Having enough money in your current account or having an arranged overdraft limit could help prevent payments such as priority bills from being returned unpaid.

On very rare occasions we may be unable to return a payment (eg due to an offline transaction made on a flight) and the account may enter an unarranged overdraft. No additional charges will be applied in this situation.

Information regarding the conduct of your account may be sent to credit reference agencies. As with any debt or borrowing, this may affect your ability to get credit in the future.

Our Eligibility tool can show you the likelihood of getting an arranged overdraft and the overdraft calculator lets you see how much it could cost to use an overdraft. To use these tools and find out more about overdraft charges, please visit barclays.co.uk/youroverdraft.

If we hold a valid mobile number for you, we’ll automatically enrol you to receive relevant alerts regarding borrowing and refused payments, to help you avoid charges. You can also choose to receive additional alerts, including Low Balance and Large Credit or Debit. Tailor your alerts to your personal needs online, by phone or in branch. To find out more, visit barclays.co.uk/alerts.

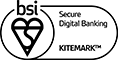

Spend, save and budget with the Barclays app

We know money can be tight when you’re studying. That’s why our app gives you lots of ways to track your spending so you can stay in control of your money.

-

See where your money goes

Check when regular payments will leave your account and compare how much you spend at shops and businesses month by month.

-

You’re in control

Can’t find your student debit card? A few taps in our app and it’s frozen temporarily. You can also get a secure PIN reminder, and set limits on how much you can take out at cash machines each day.

Frequently Asked Questions

-

You can apply in the Barclays app – you can download this from the UK App Store or UK Play Store. We’ll require proof of ID, 3 years of address history and a UK mobile phone number. You must have been living in the UK for at least 3 years to open a student account.

Documents we accept as proof of ID include

- Passport

- UK/EU/EEA full driver’s license (excluding Romanian)

- UK biometric residents card

-

Opening a student account must be done on our app. If you’re unable to apply through the app due to lack of accessibility or another issue, please call to book an appointment. Our team will be happy to help you apply.

Lines are open Monday to Sunday, 8am to 9pm

Call 0345 600 4545

We’ll require proof of ID and your UK address. Documents we accept as proof of ID include:

- UK/EU/EEA photo card driver’s licence (excluding Romanian)

- Passport

- UK biometric residence permit

We accept the following as proof of address

- UK utility bill (from last 3 months)

- Council tax bill (from last 12 months)

- Bank account statement (from last 3 months)

- Credit card statement (from last 3 months)

- UK credit union statement (from last 3 months)

- Mortgage statement (from last 12 months)

- Benefit entitlement letter (from last 12 months)

- HMRC letter (from last 12 months)

- Tenancy agreement (from last 12 months from local council or housing association)

- Council tax exemption certificate issued within the past 12 months, for the current tax year

- Foreign bank statement dated within the last 3 months that shows your UK address

- Foreign credit card statement dated within the last 3 months that shows your UK address

- HM forces family offices letter dated within the last 12 months

- UKVI trusted sponsor letter from your employer, dated within the last 3 months. It must confirm you have a fixed-term contract for at least one year.

- Royal Mail postal redirection notification to your current address, dated within the last 3 months

- Residential nursing home letter dated within the last 3 months

- Student Finance letter for the current or next academic year, dated within the last 3 months

- Universal Credit statement dated within the last 12 months

We’ll also need proof of your student status, this may include

- Trusted sponsor letter (from an educational establishment or your employer)

- A letter from your university or education provider confirming your course

-

No, you need to have been living in the UK for 3+ years to be eligible for a Barclays student bank account, but you can apply for a Barclays Bank Account through the app (subject to a successful credit check. You may alternatively be offered a Barclays Basic Bank Account).

-

Yes, you can open a Student Additions Account alongside your other current account with us.

-

No, you need to have a UK mobile phone number to apply.

-

You can find your UCAS code in your UCAS account. You will need to navigate to a different page depending on when you started your course.

- If you started in 2021 or earlier (or were due to start in 2021 but deferred to 2022), log in to your UCAS account and select ‘Opening a student bank account?’ where you’ll find your UCAS code

- If you start in 2022 or later, log into your UCAS account and select ‘Student bank account info’ where you’ll find your UCAS code

-

If you applied with UCAS and have a conditional offer from a university, you can start your application for your student account. Once your place has been confirmed, you’ll need to return to the app to submit your application.

-

If you’re a postgraduate or Higher Apprentice, you should start your application in the Barclays app. We’ll need to see confirmation of your course or apprenticeship to complete your application, so you’ll need to visit us in one of our branches – please call to book an appointment.

Lines are open Monday to Sunday, 8am to 9pm

Call 0345 600 4545

You’ll also need to bring proof of your ID and address. See which documents we accept in our “What if I can’t apply on the app? FAQ

-

All overdrafts are subject to application, financial circumstances, borrowing history and lending criteria.

Our maximum interest-free arranged student overdraft limits are

- From account opening and during your first term – up to £500

- Year 1 – up to £1,000

- Year 2 and beyond – up to £1,500

If we agree to arrange an overdraft, your limit could be lower than the maximum limits. All overdrafts are subject to application, financial circumstances, borrowing history and lending criteria. Arranged overdrafts are repayable on demand. Interest charges are variable.

-

Contact Perlego’s customer services at: help@perlego.com

-

You can cancel your account any time up to 14 days after either opening it or receiving your account terms and conditions – whichever is later.

-

It takes about 10 to 15 minutes to enter the details we need. If we approve your application, you’ll get your account details and can start using the account straight away. Your debit card and PIN will arrive separately within five working days.

Applying in the Barclays app

If you already have the app

Go to ‘Products’, then ‘Current accounts’ to apply.

Account information and fees

Read all the details about banking with us and the terms and conditions of our Student Additions Account.

-

-

Current accounts – our bank charges explained [PDF, 1.4MB]7

-

Fee Information Document - Student Additions [PDF, 360KB]

14-day trial period

If you’re not happy with your account, you have a 14-day period in which to cancel your account or switch to another account. This begins on the account opening date or the date you receive your terms and conditions and other account information, whichever is later.

Your feedback

We want to hear from you if you’re unhappy with our service. You can complain in person, at a branch, in writing, by email or by phone. You can get a leaflet detailing how we deal with complaints in any of our branches, on this site or from the Barclays Information Line on 0800 400 1004. The line is open between 7am to 11pm, seven days a week. Alternatively, write to Barclays, Leicester LE87 2BB.

If we don’t resolve your complaint internally to your satisfaction, you may be able to refer it to The Financial Ombudsman Service, Exchange Tower, London, E14 9SR (08000 234 567). The Financial Ombudsman Service is an organisation set up by law to give consumers a free and independent service for resolving disputes with financial firms. Details of those who are eligible complainants can be obtained from the Financial Ombudsman Service.